- Activity on Jupiter, Solana’s largest DEX, exceeds numbers on Ethereum-based Uniswap

- ETH volume continues to be higher than SOL, but JUP and UNI sentiment is different

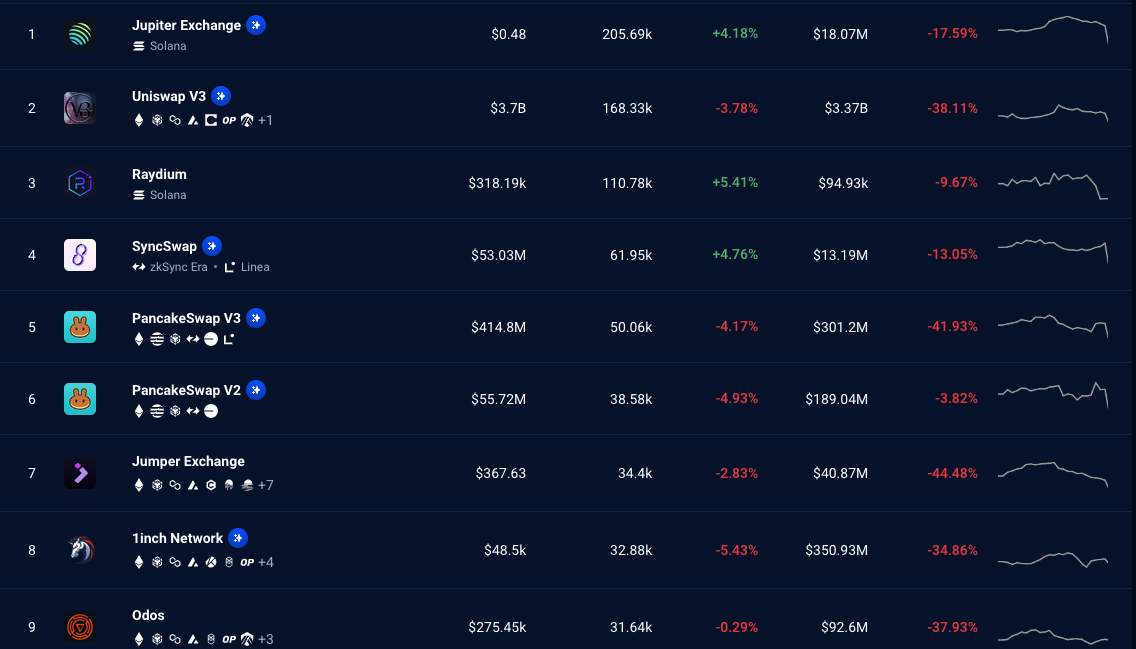

Jupiter, a decentralized exchange built on the Solana blockchain, has overtaken Uniswap as the DEX with the highest number of unique active wallets (UAWs). AMBCrypto noticed this by looking at data from his DappRadar.

At the time of writing, UAW on the Jupiter exchange was over 205,000. Uniswap built on Ethereum [ETH]it was less than 170,000.

How did that happen?

UAW measures crypto wallet addresses that interact with a network or application. If a metric increases, it means an increase in user activity. On the other hand, a decrease suggests less attention.

As seen below, Jupiter's active wallets have increased over the past 24 hours, while Uniswap's active wallets have decreased. However, this is not just about his aforementioned DEX. Instead, it details the competition between Solana and Ethereum.

Source: DappRadar

For many years, Ethereum dominated Solana on this front. However, this cycle is different, and there's a reason why. First, Solana is the chain that produces most of the top meme coins.

Several blockchains have appeared on the blockchain developed by Vitalik Buterin, but none could match Solana. For example, you can also mention dogwifhat. [WIF]bonk [BONK]pop cat [POPCAT] As part of the meme coin that has grown incredibly in Solana. PEPE, on the other hand, seems to be the only major that came out from elsewhere.

Besides the emergence of tokens, another factor that plays a role is transaction fees. Research revealed that the low fees Solana offers helps retain traders. Ethereum fees are lower than they used to be, but they are still far from Solana fees.

Simply put, the DEX takeover was the result of a combination of these factors.

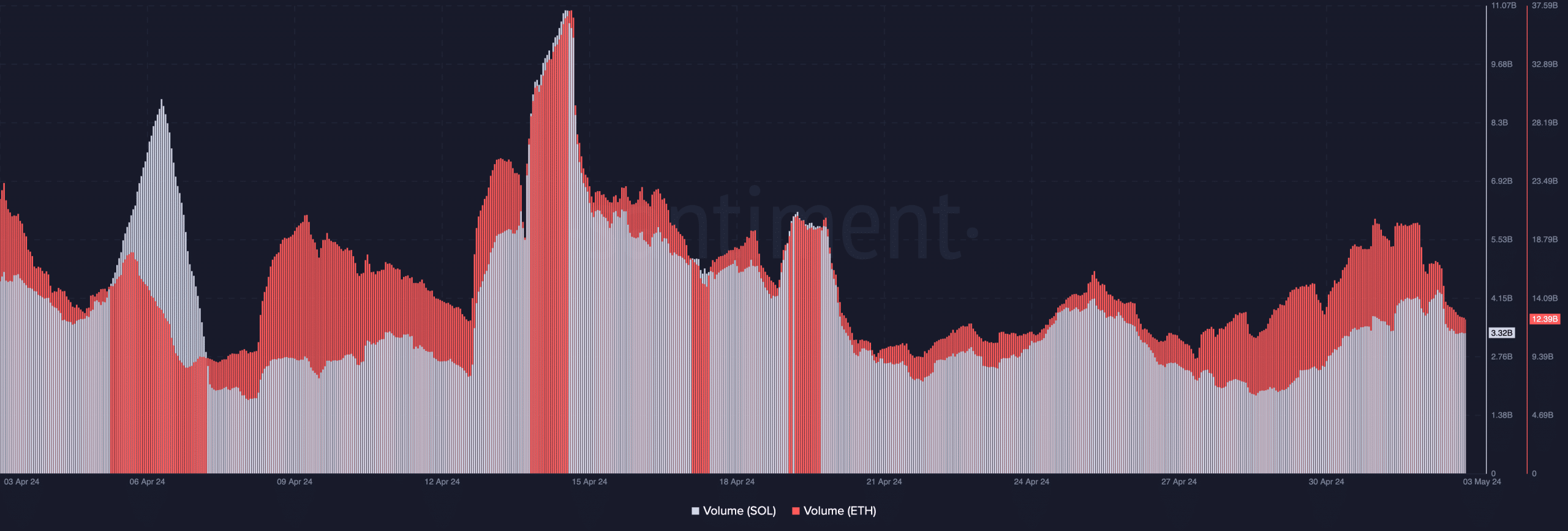

Having said that, on-chain data also reveals that Ethereum’s volume is still much larger than Solana’s.

Source: Santiment

ETH, UNI overtake SOL, JUP in some aspects

At the time of writing, Solana's trading volume was $3.32 billion. Ethereum, on the other hand, recorded a figure of $12.39 billion. However, in terms of price, SOL led ETH in terms of growth.

At the time of writing, SOL was trading at $139.03. This is an increase of 537.65% over the past 365 days. During the same period, the price of ETH increased by “only” 61.10%.

If this performance remains the same over the next few months, SOL could beat ETH throughout this cycle. However, it is important to note that the DEXs discussed here also have native tokens.

Jupiter's ticker is JUP. His UNI on Uniswap is much more “older” than the former and therefore more popular. At the time of writing, JUP's price is $1.02, representing an increase of 75.53% in the past 90 days.

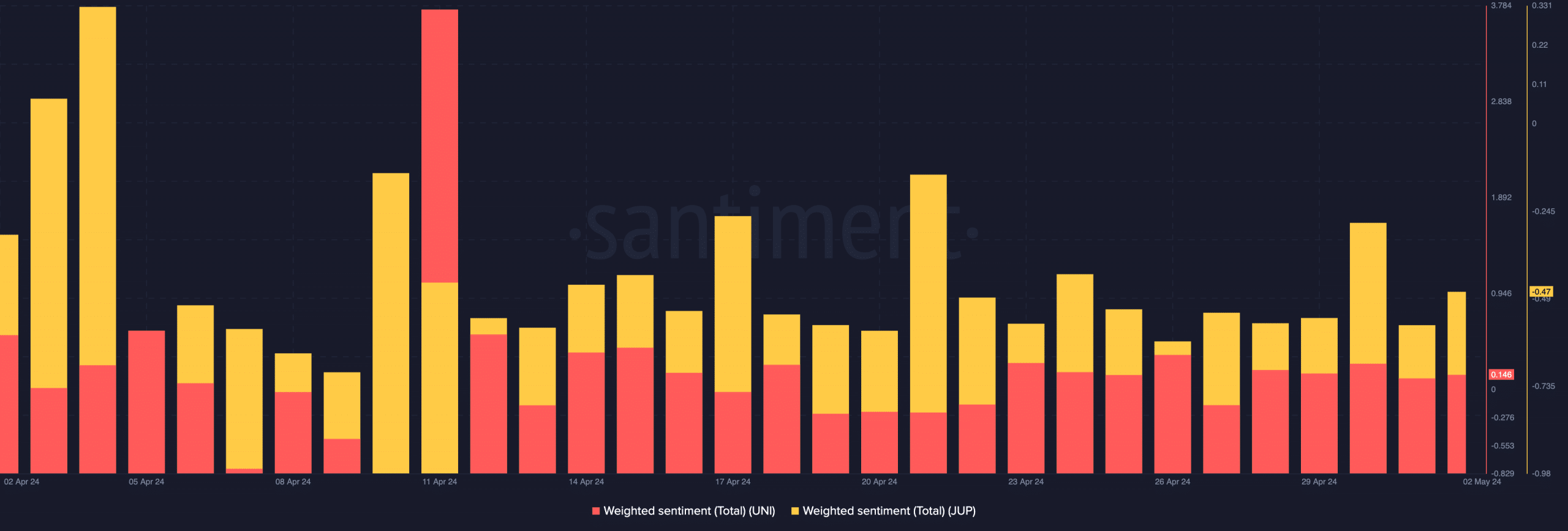

On the other hand, UNI changed its trading at $7.08 after increasing its price by 14.54% within the same period. However, his JUP weighted sentiment based on Solana was negative, regardless of price action.

Ethereum-based UNI is green, indicating that market participants are more bullish on UNI than JUP. However, sentiment without action may not impact price as JUP may continue to outperform UNI.

Source: Santiment

Realistic or not, SOL's market cap in ETH terms is:

For Ethereum and Solana, the battle may not stop anytime soon. Therefore, participants may need to pay attention to the development of their respective blockchains.