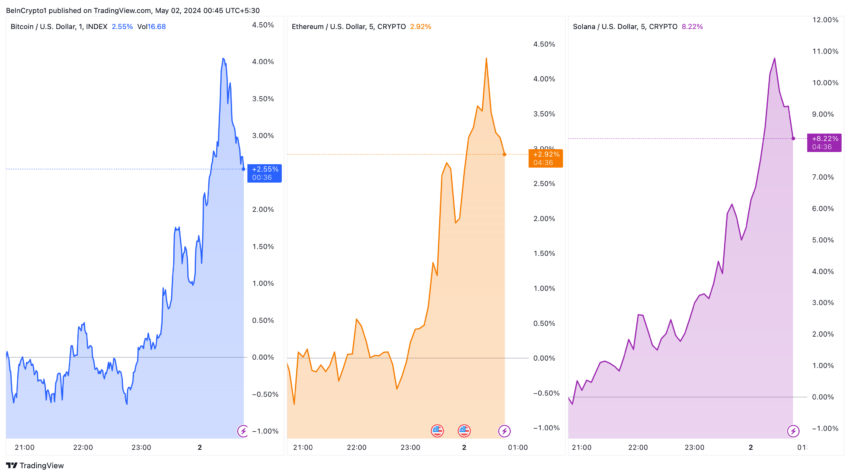

Bitcoin, Ethereum, and Solana experienced a significant rally following the latest Federal Reserve announcement from Chairman Jerome Powell.

Bitcoin, Ethereum, and Solana have seen significant price increases, consistent with Chairman Powell's insights at the Federal Open Market Committee meeting.

Cryptocurrency market soars after Jerome Powell's remarks

Despite persistent inflation concerns, the Fed chose a wait-and-see approach, maintaining its current benchmark interest rate. Powell emphasized that there remain challenges in bringing inflation down to the Fed's 2% goal and said the Fed's next action is unlikely to be a rate hike.

Instead, the focus remains on prudent financial strategy, reflecting the Committee's readiness to adapt as necessary to protect economic stability.

“So far this year, the data has not given us particularly great confidence. And, as I said, the readings on inflation have been better than expected. “This is likely to take longer than previously anticipated,” Powell said.

Amid these developments, the crypto market reacted positively, demonstrating investors' optimism regarding a stable interest rate environment. Bitcoin rose 5% to $59,440, Ethereum rose 5.02% to $3,015, and Solana rose 11% to $136.

This stability in interest rates often leads to increased investment in riskier assets like cryptocurrencies, as seen in the significant appreciation across major digital currencies.

Read more: How to protect yourself from inflation using cryptocurrencies

Additionally, the Fed announced a slowdown in the pace of balance sheet reductions scheduled to begin in June. This adjustment is intended to prevent market volatility like the one experienced in September 2019.

Starting June 1, the Fed will reduce monthly debt outflows from $60 billion to $25 billion. Still, it will continue to allow $35 billion a month in outflows of mortgage-backed securities and direct the surplus to U.S. Treasuries.

This strategic shift reflects a broader intention to move toward holding primarily U.S. Treasuries, with the aim of streamlining the central bank's balance sheet operations and strengthening its ability to respond to market trends. . Powell concluded his speech by reiterating the Fed's vigilance against inflation risks and its commitment to a restrictive policy stance to support economic activity.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.