- Lido's price increase will lead to an increase in the market capitalization of liquidity staking assets.

- At the time of this writing, LDO was trading at around $2.13.

As last week draws to a close and a new one begins, Ethereum [ETH] I experienced a slight backlash. Similarly, Lido Dao witnessed a similar move.

According to the data, the amount of Ethereum staked continued to increase, but DAOs also maintained their dominance.

Lido Rise Supports Liquidity Staking Market Cap

According to Santiment data, Liquid staking assets performed well over the weekend, with Lido being one of the notable gainers.

According to the report, the market capitalization of liquidity staking assets surged by more than 5%. Specifically, LDO showed a commendable increase of more than 5% during this period.

Lido trends

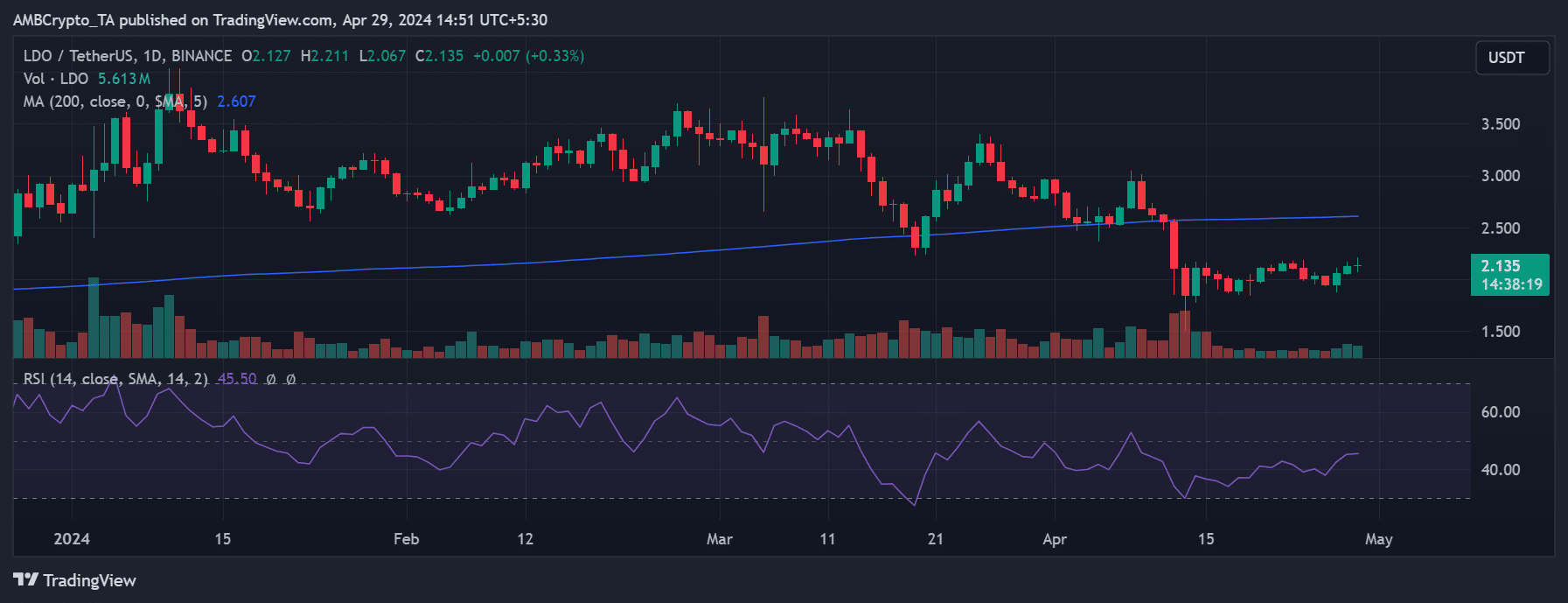

Analysis of Lido Dao price trend on daily timeframe chart reveals that it has shown a positive trajectory at the end of the previous week.

On April 27th, LDO experienced a significant increase of over 5%, reaching a trading price of approximately $2.05. The uptrend continued on the next day, April 28th, with an additional 3% rise, bringing the price to around $2.12.

As of this writing, it is trading at around $2.13, a slight increase of less than 1%.

Source: TradingView

If this trend continues until the end of April 29th, LDO will be in a three-day uptrend for the first and only time this month. Prior to this, the last time such an upward trend was observed was in his March, and it only occurred once.

Moreover, Relative Strength Index (RSI) analysis shows that LDO is still bearish despite the recent positive movement.

At the time of writing, the RSI was below the neutral zone. A closer look suggests that since February, LDO has not remained above the neutral zone for an extended period of time, indicating that the bearish trend of recent months has prevailed.

However, despite the price fluctuations, the platform continues to maintain its dominance in Ethereum staking.

Lido gets the most Ethereum stakes

According to data from Dune Analytics, more than 32 million Ethereum have been staked to date, accounting for more than 27% of the total supply.

Notably, Lido contributes significantly to this number, accounting for 28% of the total staked ETH. This equates to over 9.3 million ETH staked through Lido.

Is your portfolio green? Check out the Lido Profit Calculator

Additionally, the data reveals that staking activity has increased by approximately 6% over the past six months, demonstrating the platform's continued dominance in Ethereum staking.

However, a closer look at the data also reveals a recent decline in net staking flows over the past few weeks. This decline coincided with a decline in the prices of Lido’s native token (LDO) and Ethereum.