Posted on April 12, 2024 at 1:02 PM ET.

Ethereum on Friday marked the one-year anniversary of the Shappera upgrade, which moved the blockchain from a proof-of-work verification system to a more energy-efficient proof-of-stake.

This upgrade took place on April 12, 2023, and allowed stakeholders to withdraw their Ether (ETH), which was securing and validating the second largest blockchain network.

A year later, Ethereum Several things have changed, from the volatility of staked ETH to the number of validators in the ecosystem. Below are five charts showing how Ethereum has progressed since Shapella.

1. Total number of ETH stakes to secure Ethereum

Ether staked has increased significantly over the past year from 20 million to 32.2 million ETH. Nansen The data shows.

Despite a slight decline in staking ETH from centralized exchanges that started withdrawing after Shapella's rollout, staking ETH has increased by 61% since then, and based on recent pricing, staking Ethereum Recorded $42 billion inflows into infrastructure.

Before Shapella, aspiring validators had one choice. That is to deposit her ETH into an Ethereum staking contract. Assets could not be withdrawn.

“Based on how the total amount of ETH staked on Ethereum has increased dramatically since the Shanghai Stock Exchange. [or the Shapella] It is clear that the activation of staking ETH withdrawals on the network following the upgrade was an important event in de-risking staking activities,” said Christine Kim, vice president of research at Galaxy, in an e-mail. stated in an email.

Shapella helped de-risk Ethereum. This is because the stakeholders have obtained an exit window without significant penalties for failing to meet their obligations. At the time of publication, staked ETH accounted for 26.94% of assets. Total supply: 120 million pieces.

Mike Neuder of the Ethereum Foundation said: March blog Factors are set to drive demand for staked ETH. These include rising ETH prices, increased re-staking demand, lower interest rates that may cause financial institutions to seek alternative yields, the popularity of liquidity staking, and the potential for exchange-traded fund providers to promote ETH staking. It is included.

However, Kim noted that Ethereum developers are concerned that the supply of staked ETH will increase “excessively and rapidly” due to increased demand.

read more: Why the Ethereum community opposes proposed monetary policy changesrhinoceros

2. Number of validators

Validators have grown significantly since Shapella, allaying “concerns among some in the Ethereum community that being able to withdraw ETH from the Beacon Chain would lead to a mass exodus of validators.” Austin Blackerby, EVM Analytics Manager at Flipside Crypto, told Unchained via Telegram.

Approximately 563,000 validators Safe Ethereum as of April 12, 2023. Since then, this number has skyrocketed by more than 74% for him to around 981,000 validators.

“Furthermore, interest in joining our active validator set has increased significantly over the past 30 days, with current wait times for new validators of over nine days,” Blackerby said. . “On the contrary, there is virtually no queue to exit the validator set. This means there is much more demand for becoming validators than there is demand for leaving the network.”

The continued increase in validators has raised further concerns among protocol developers and researchers. Galaxy's Kim pointed out two main reasons in a September 2023 article. report.

“First, a large validator set size puts a strain on peer-to-peer networking and messaging, which can lead to node failures due to high computational load and bandwidth requirements,” Kim wrote. A large validator set also makes future upgrades “more difficult to accomplish and more risky,” she added.

In the next upgrade, “Electra” It is expected to address the growing set of validators. Electra includes EIP-7251, an improvement proposal to reduce validators by increasing the maximum ETH that validators can stake. EIP-7251 aims to allow validators to stake up to 2,048 ETH instead of the current limit of 32 ETH.

read more: What is Ethereum's EIP-7251 (MaxEB)? Beginner's Guide

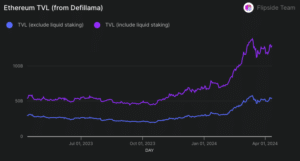

3. Total value lock (TVL)

Ethereum’s TVL spiked after the withdrawal activation. On April 12, 2023, a user locked $54.69 billion in decentralized finance (DeFi) applications, with 54% coming from liquid staking. Since then, TVL has increased over 131% to $126.75 billion, with Liquid Staking accounting for approximately 42%.

Ethereum maintains its top position on TVL, followed by Tron, Binance Smart Chain, and Solana, according to Defilama. One of the factors driving growth was the rise in the price of ETH, which soared 79% from $1,920 at the time of Shappera's deployment to approximately $3,440 at the time of publication.

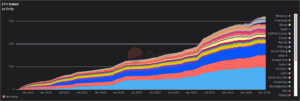

4. Lido leads the group

ETH holders have two ways to stake: solo home staking or using a third party.

Smart contract protocol Lido is widely known for its liquid staking technology and manages around 9.4 million staked ETH, which is worth around $33 billion. This represents 29% of the total staked ETH.

Liquid staking refers to staking ETH and receiving “receipt” tokens representing principal and rewards. While ETH is locked, stakers can use the “received” tokens as liquidity in DeFi applications.

At the time of Shapella, Lido led the pack in terms of ETH staked, boasting a 2.97 million ETH lead over Coinbase. Lido has expanded its lead over the past year. At the time of publication, Lido had approximately 9.4 million ETH staked.

Liquid staking competition is heating up. Renzo, Stader, Mantle, and the Ether.Fi protocol said that at the time ETH withdrawals started, he was not staking any ETH, but now he is responsible for staking 2.16 million ETH. Think about what you are doing.

5. Unstake ETH

Although staking withdrawals have never exceeded deposits, withdrawal patterns have changed since Shapella.

In the aftermath of Shapella in 2023, centralized exchanges became the main withdrawals of staked ETH. According to , during the week the exchange withdrew 138,912 ETH from securing the blockchain, dwarfing the total of 72,792 ETH withdrawn from all other categories. dune dashboard.

A year later, withdrawals of staked ETH are now primarily done through the Liquid Staking protocol. Since Monday, centralized exchanges have withdrawn 84,128 staked ETH, while Liquid Staking protocols were responsible for 121,472 staked ETH withdrawals. Lido, which withdrew its staked ETH on Thursday, saw its staked ETH decrease by 1% in the past week and 4% in the last month.