A recent study of the top 300 cryptocurrencies by market capitalization revealed that more than 20% of these coins have the majority of their tokens yet to be unlocked.

This finding is extremely important to investors and market analysts given its potential to impact market prices and investor sentiment.

Most new crypto projects enable massive supply

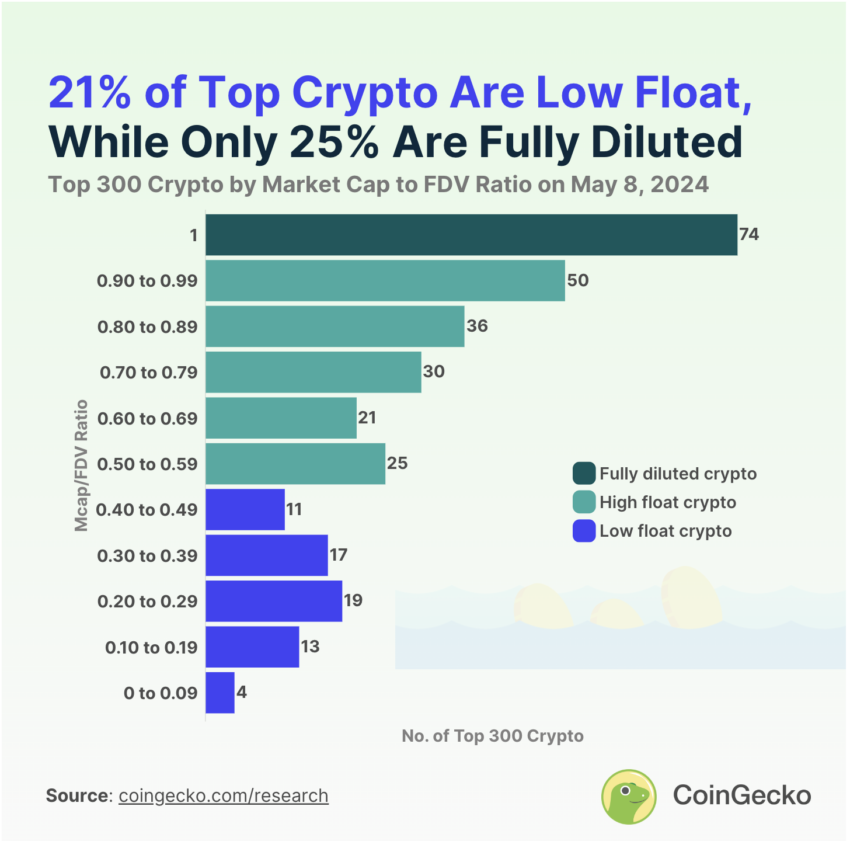

Utilizing data from CoinGecko as of May 8, 2024, we excluded stablecoins and wrapped assets in our analysis. We focused on the ratio of market capitalization to fully diluted valuation (FDV).

“For the purposes of this study, low-float cryptocurrencies are defined as having a market capitalization to FDV ratio of 0 to 0.49, high-float cryptocurrencies have a ratio of 0.50 to 0.99, and only cryptocurrencies with a ratio of 1 are fully ” CoinGecko explained.

Importantly, low float cryptocurrencies account for 21.3% of these top 300 coins. This suggests that a large amount of supply is coming to the market in the coming days. Among these, World Coin (WLD) has the lowest ratio at 0.02, followed by Cheely (CHEEL) at 0.06, Starknet (STRK) at 0.07, and Saga (SAGA) at 0.09.

All of these cryptocurrencies were launched in 2023 or 2024 and are new additions to the market.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

This low float trend is mostly seen in cryptocurrencies introduced in the past four years. In fact, 54 of the 64 low-float large-cap cryptocurrencies were issued during this period. This influx of new projects shows the dynamic expansion within the crypto space and indicates that the market may change as these tokens become available.

Looking to the near future, the market will see an immediate impact from the planned token unlocking.

For example, on May 12, Aptos will release 11.31 million APT tokens worth nearly $100 million, representing 2.64% of its circulating supply, according to Token Unlocks data. Additionally, on May 16th, Arbitrum will unlock 92.65 million ARB tokens worth over $96 million, or 3.49% of the circulating supply.

These releases can cause significant selling pressure on their respective tokens.

Additionally, BeInCrypto reports that around $3.58 billion worth of tokens will be unlocked across various projects this month. This large sum highlights the scale at which these unlocks could impact broader markets and increase volatility.

Read more: What is Tokenomics? A basic guide

In contrast to newer cryptocurrencies, older cryptocurrencies generally have higher FDV ratios. Notable examples include Maker (MKR), Aave (AAVE), and Near Protocol (NEAR), with ratios of 0.95, 0.93, and 0.90, respectively. This indicates that most of the potential supply is already in circulation, which is significantly different from less than half of newly launched cryptocurrencies achieving complete dilution.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.